Introduction

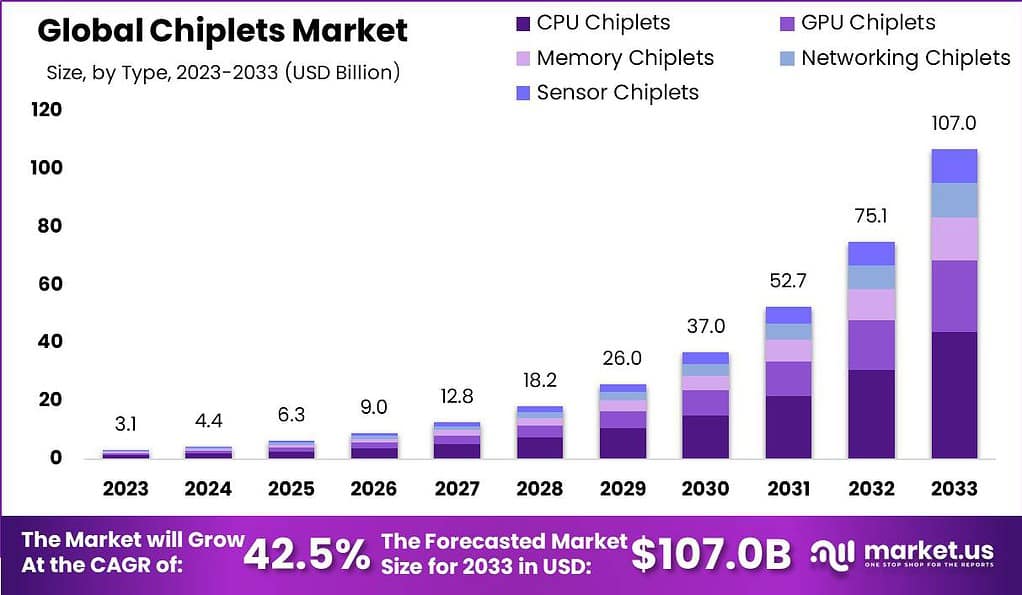

The Global Chiplets Market is projected to experience substantial growth, with its market size expected to reach USD 107.0 Billion by 2033, up from USD 3.1 Billion in 2023. This represents a robust compound annual growth rate (CAGR) of 42.5% during the forecast period from 2024 to 2033. In 2023, the Asia-Pacific (APAC) region emerged as a dominant force in the market, capturing over 40% of the market share. APAC’s leading position is largely driven by its advanced semiconductor manufacturing capabilities and rapid technological advancements, positioning the region as a key player in the global chiplets market.

Chiplets represent a revolutionary approach in semiconductor manufacturing, where different components of a chip are manufactured separately and then integrated onto a single package. This method offers several advantages over traditional monolithic chip designs, primarily in scalability and flexibility. By using chiplets, manufacturers can mix and match functionalities, such as CPUs, GPUs, and memory, to tailor chips according to specific needs and applications. This modularity also reduces production costs and time to market, as each component can be optimized and fabricated using the process best suited to its function.

The demand for chiplets is driven by the increasing complexity of applications requiring high-performance computing, such as artificial intelligence, data centers, and high-end computing devices. The growth of the chiplets market is fueled by their ability to efficiently meet these demands while mitigating the limitations of traditional chip architectures, such as yield degradation and escalating costs with advanced node technologies.

The opportunity for chiplets lies in their potential to significantly alter the semiconductor industry’s landscape. They enable smaller companies to compete by focusing on specialized chiplet designs without the need for extensive foundry capabilities. Furthermore, as systems become more data-centric, chiplets offer a viable solution to enhance performance and functionality in a cost-effective and flexible manner. This adaptability is crucial for keeping pace with the rapid advancements in technology and the expanding range of applications in the digital age.

Source@ market.us

Chiplets Statistics

- The Chiplets Market is poised for exceptional growth, with a projected CAGR of 42.5% over the next decade, reaching a significant valuation of USD 107.0 billion by 2033. In 2024, the market is expected to continue its upward trajectory, with an estimated value of USD 4.4 billion.

- CPU Chiplets dominated the market in 2023, securing over 41% of the market share. Their dominance is attributed to their efficiency in enhancing processing power while maintaining energy efficiency, which makes them highly valuable in high-performance computing applications.

- The Consumer Electronics segment held a leading position in 2023, with more than 26% of the market share. The rapid technological advancements in devices such as smartphones, laptops, and wearables, where chiplets provide scalability and flexibility, are key drivers for this growth.

- The IT and Telecommunication Services segment accounted for over 24% of the market share in 2023, driven by the rising demand for high-performance computing solutions in data centers and the increasing need for efficient network infrastructure.

- Asia-Pacific (APAC) emerged as a dominant force in 2023, capturing over 40% of the global chiplets market. The region’s advanced semiconductor manufacturing capabilities and rapid technological progress in countries such as China, South Korea, and Taiwan are driving this growth.

- North America holds a substantial market stake, accounting for approximately 29.8% of the global market share in 2023. This can be attributed to the strong presence of major semiconductor manufacturers and the high demand for cutting-edge technologies.

- Europe also plays a significant role, with a market share of around 20.9%. Leading contributions come from countries such as Germany, the UK, and France, where the demand for chiplets in various industrial applications continues to rise.

- Latin America represents a smaller yet steadily growing market, holding a 5.7% market share in 2023. The region is expected to see gradual growth in the chiplets sector as technological adoption increases.

- The Middle East and Africa represent an emerging market with a 3.1% share in 2023. Although currently in its early stages, the region is showing promising growth potential in the chiplets industry.