-

Report ID 134745 -

Published Date 06 Dec -

Delivery Format PDF/PPT/Word -

Editor's Rating

-

Report Details

Introduction: What is Credit Insurance?

Credit insurance is a type of financial protection that covers the debt owed on a loan or credit card in the event of a borrower’s death, disability, or involuntary unemployment. It is designed to provide peace of mind for borrowers and their families by ensuring that outstanding debts are not passed on to them in the event of unexpected hardship.

The cost of credit insurance varies depending on the amount being borrowed and other factors such as age and health. Generally, it is calculated as a percentage of the total loan amount, with premiums paid either upfront or spread out over time. There may also be additional fees associated with setting up a credit insurance policy or making changes to existing coverage.

Market Insight:

The credit insurance market is a rapidly growing sector that provides businesses with protection against losses due to the non-payment of invoices by customers. Credit insurance is an important tool for companies that rely on the timely payment of their debts, as it safeguards them against potential losses resulting from delayed or defaulted payments. With the increasing complexity of international transactions and tightening regulatory standards, credit insurers are offering more comprehensive solutions to serve the needs of global organizations.

The Credit Insurance Market size was valued at USD 6506.79 Million in 2022 and is projected to reach USD 8145.43 Million by 2030, growing at a CAGR of 4.1% from 2023 to 2030. It is expected to continue its rapid growth over the next few years, owing to its ability to reduce risk exposure and strengthen financial stability for companies. This growth can be attributed to rising demand from small-to-medium-sized enterprises (SMEs), as they look for ways to manage their accounts receivable without straining their working capital reserves.

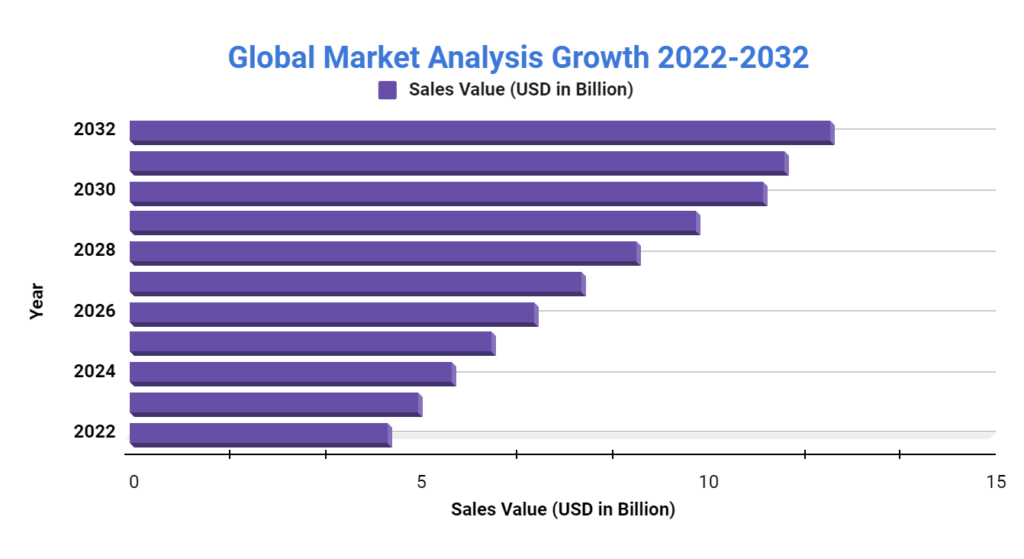

Figure: The below figure indicated a graphical representation of the report along with market Sales Value (USD In Bn) & Y-O-Y growth rate:

Growth in manufacturing and industrialization are the primary factors driving market expansion. Due to the activities in downstream businesses, the market has experienced rapid growth in flap discs over the last decade. The development phase has seen significant changes due to both the expansion in production capacity and the investment made by the downstream businesses. Both the expansion in production capacity and the economic investments have significantly affected the growth phase.

Competitive Spectrum – Top Companies leveraging Credit Insurance Market:

Euler Hermes

Atradius

Coface

Zurich

Credendo Group

QBE Insurance

CesceImportant Developments

ZURICH Insurance Group LTD. announced that it has acquired Adira Insurance.

AIG announced that it had signed a definitive agreement for Glatfelter Insurance Group acquisition.

Key Segments

Segment by Component:Product

ServicesSegment by Coverages:

Whole Turnover Coverage

Single Buyer CoverageSegment by Enterprises Size:

Large Enterprises

Medium Enterprises

Small EnterprisesSegment by Application:

Domestic

InternationalSegment by Industry Vertical:

Food and Beverages

I.T.and TelecomMetals and Mining

Healthcare

Energy and Utilities -

Table Of Content

1. Credit Insurance Market Introduction

1.1. Definition

1.2. Taxonomy

1.3. Research Scope2. Executive Summary

2.1. Key Findings by Major Segments

2.2. Top strategies by Major Players3. Global Credit Insurance Market Overview

3.1. Credit Insurance Market Dynamics

3.1.1. Drivers

3.1.2. Opportunities

3.1.3. Restraints

3.1.4. Challenges3.2. PESTLE Analysis

3.3. Opportunity Map Analysis

3.4. PORTER’S Five Forces Analysis

3.5. Market Competition Scenario Analysis

3.6. Product Life Cycle Analysis

3.7. Opportunity Orbits

3.8. Manufacturer Intensity Map4. Global Credit Insurance Market Value (US$ Mn), Share (%), and Growth Rate (%) Comparison by Type, 2012-2028

4.1. Global Credit Insurance Market Analysis by Type: Introduction

4.2. Market Size and Forecast by Region

4.3. Commercial4.4 Investment Insurance

5. Global Credit Insurance Market Value (US$ Mn), Share (%), and Growth Rate (%) Comparison by Application, 2012-2028

5.1. Global Credit Insurance Market Analysis by Application: Introduction

5.2. Market Size and Forecast by Region

5.3. Domestic Trade

5.4. Export Trade6. Global Credit Insurance Market Value (US$ Mn), Share (%), and Growth Rate (%) Comparison by Region, 2012-2028

6.1. North America

6.1.1. North America Credit Insurance Market: Regional Trend Analysis

6.1.1.1. US

6.1.1.2. Canada

6.1.1.3. Mexico6.2. Europe

6.2.1. Europe Credit Insurance Market: Regional Trend Analysis

6.2.1.1. Germany

6.2.1.2. France

6.2.1.3. UK

6.2.1.4. Russia

6.2.1.5. Italy

6.2.1.6. Rest of Europe6.3. Asia-Pacific

6.3.1. Asia-Pacific Credit Insurance Market: Regional Trend Analysis

6.3.1.1. China

6.3.1.2. Japan

6.3.1.3. Korea

6.3.1.4. India

6.3.1.5. Rest of Asia6.4. Latin America

6.4.1. Latin America Credit Insurance Market: Regional Trend Analysis

6.4.1.1. Brazil

6.4.1.2. Argentina

6.4.1.3. Rest of Latin America6.5. Middle East and Africa

6.5.1. Middle East and Africa Credit Insurance Market: Regional Trend Analysis

6.5.1.1. GCC

6.5.1.2. South Africa

6.5.1.3. Israel

6.5.1.4. Rest of MEA

7. Global Credit Insurance Market Competitive Landscape, Market Share Analysis, and Company Profiles7.1. Market Share Analysis

7.2. Company Profiles

7.3. Euler Hermes7.3.1. Company Overview

7.3.2. Financial Highlights

7.3.3. Product Portfolio

7.3.4. SWOT Analysis

7.3.5. Key Strategies and Developments7.4. Atradius

7.4.1. Company Overview

7.4.2. Financial Highlights

7.4.3. Product Portfolio

7.4.4. SWOT Analysis

7.4.5. Key Strategies and Developments7.5. Coface

7.5.1. Company Overview

7.5.2. Financial Highlights

7.5.3. Product Portfolio

7.5.4. SWOT Analysis

7.5.5. Key Strategies and Developments7.6. Zurich

7.6.1. Company Overview

7.6.2. Financial Highlights

7.6.3. Product Portfolio

7.6.4. SWOT Analysis

7.6.5. Key Strategies and Developments7.7. Credendo Group

7.7.1. Company Overview

7.7.2. Financial Highlights

7.7.3. Product Portfolio

7.7.4. SWOT Analysis

7.7.5. Key Strategies and Developments7.8. QBE Insurance

7.8.1. Company Overview

7.8.2. Financial Highlights

7.8.3. Product Portfolio

7.8.4. SWOT Analysis

7.8.5. Key Strategies and Developments7.9. Cesce

7.9.1. Company Overview

7.9.2. Financial Highlights

7.9.3. Product Portfolio

7.9.4. SWOT Analysis

7.9.5. Key Strategies and Developments8. Assumptions and Acronyms

9. Research Methodology

10. Contact -

Inquiry Before Buying

Research Insights & Deliverables

Development and Future Forecast

Development and Future Forecast Competitive benchmarking

Competitive benchmarking Company Revenue Statistics

Company Revenue Statistics Rising Regional Opportunities

Rising Regional Opportunities Technology Trends and Dynamics

Technology Trends and Dynamics Technology Assessment

Technology Assessment

-

Request Sample

Research Insights & Deliverables

Development and Future Forecast

Development and Future Forecast Competitive benchmarking

Competitive benchmarking Company Revenue Statistics

Company Revenue Statistics Rising Regional Opportunities

Rising Regional Opportunities Technology Trends and Dynamics

Technology Trends and Dynamics Technology Assessment

Technology Assessment