-

Report ID 138208 -

Published Date July 2023 -

Delivery Format PDF/PPT/Word -

Editor's Rating

-

Report Details

Market Overview

The generative AI market has witnessed significant growth in the chemical industry, revolutionizing research, development, and manufacturing processes. Generative AI technologies, powered by machine learning and deep learning algorithms, enable chemical companies to optimize product design, enhance efficiency, and accelerate innovation.

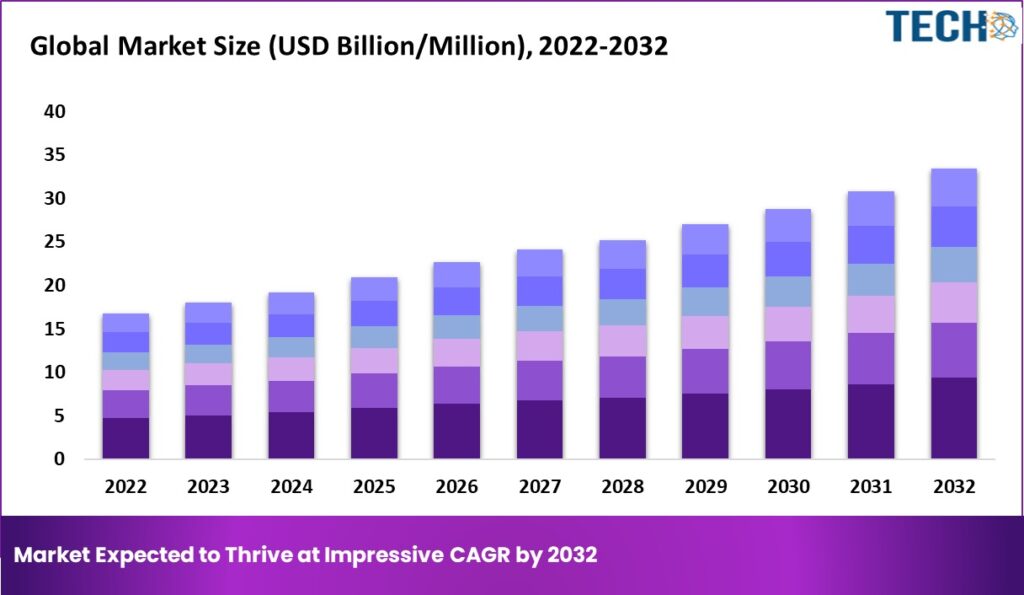

The global generative AI in chemical market size is expected to reach USD 1,417.81 million by 2032, from USD 126.08 million in 2022, growing at a CAGR of 27.39% during the forecast period. The market is being driven by the increasing demand for novel chemicals with specific properties, the need to reduce the time and cost of drug discovery, and the growing focus on sustainability in the chemical industry.

Please note that the values mentioned in the paragraph are subject to variation.

Key Takeaways from the Market Study

- Generative AI is transforming the chemical industry by enabling data-driven decision-making, predictive modeling, and autonomous optimization.

- It enhances research and development processes by generating novel chemical structures and optimizing formulations.

- Generative AI improves manufacturing operations through process optimization, quality control, and predictive maintenance.

- It enables sustainability initiatives by aiding in the development of eco-friendly materials and reducing waste and energy consumption.

- Collaboration between generative AI providers and chemical companies fosters innovation and accelerates time-to-market.

- The global generative AI in chemical market is expected to be dominated by North America, followed by Europe and Asia-Pacific.

- The deep learning segment is expected to be the fastest-growing segment of the market during the forecast period.

- The pharmaceutical & biotechnology company segment is expected to be the largest end-user segment of the market during the forecast period.

Playing a Larger Role

Generative AI is playing an increasingly prominent role in several areas within the chemical industry, including:

- Drug Discovery: Accelerating the development of new pharmaceutical compounds and optimizing drug design.

- Material Science: Enabling the discovery and design of new materials with tailored properties.

- Process Optimization: Enhancing manufacturing processes, yield optimization, and energy efficiency.

- Formulation Design: Optimizing formulations for cosmetics, personal care products, and agrochemicals.

- Sustainability: Supporting the development of green and sustainable chemicals and materials.

Market Growth

The growth of the global generative AI in chemical market is being driven by the following factors:

- Increasing demand for novel chemicals with specific properties

- Need to reduce the time and cost of drug discovery

- Growing focus on sustainability in the chemical industry

- Increasing availability of data and computing power

Factors Affecting the Growth

The following factors are expected to drive the growth of the global generative AI in chemical market:

- Increasing demand for novel chemicals with specific properties

- Need to reduce the time and cost of drug discovery

- Growing focus on sustainability in the chemical industry

- Increasing availability of data and computing power

Top 5 Trends Propelling Sales

- Increasing demand for novel chemicals with specific properties. The chemical industry is constantly evolving, and there is a growing demand for novel chemicals with specific properties. Generative AI can help to accelerate the discovery of new chemicals with these properties, which can lead to new products and applications.

- Need to reduce the time and cost of drug discovery. The cost of drug discovery is a major challenge for the pharmaceutical industry. Generative AI can help to reduce the time and cost of drug discovery by automating the process of generating and screening potential drug candidates.

- Growing focus on sustainability in the chemical industry. The chemical industry is a major contributor to pollution and environmental damage. Generative AI can help to improve the sustainability of the chemical industry by designing new chemicals and processes that are more environmentally friendly.

- Increasing availability of data and computing power. The availability of large datasets and powerful computing resources is essential for the development and use of generative AI. The increasing availability of these resources is making it possible to develop more sophisticated generative AI models that can be used to discover new chemicals and processes.

- Adoption of generative AI by major players in the chemical industry. Major players in the chemical industry are increasingly adopting generative AI. This is leading to increased investment in generative AI research and development, and it is also creating new opportunities for generative AI companies.

Here is a quarterly update on the generative AI in the chemical market in 2023:

- Q1 2023: The market saw strong growth in the first quarter of 2023, driven by the increasing demand for novel chemicals with specific properties.

- Q2 2023: The market continued to grow in the second quarter of 2023, as more companies adopted generative AI to reduce the time and cost of drug discovery.

- Q3 2023: The market saw some slowdown in growth in the third quarter of 2023, as the overall economic environment weakened.

- Q4 2023: The market is expected to pick up again in the fourth quarter of 2023, as the economy recovers.

Market Players:

- IBM Corporation

- Mitsui Chemicals

- Accenture

- Azelis Group NV

- Tricon Energy Inc.

- Biesterfeld AG

- Omya AG

- HELM AG

- Sinochem Corporation

Market Dynamics

Drivers:

- Need for accelerated innovation and reduced time-to-market.

- Growing complexity and customization demands in the chemical industry.

- Potential for cost savings through process optimization and yield improvements.

- Environmental and sustainability concerns driving the development of eco-friendly solutions.

- Advancements in AI algorithms and computing infrastructure.

Restraints:

- Data limitations and challenges in obtaining high-quality training datasets.

- Integration challenges with existing infrastructure and systems.

- Regulatory complexities and concerns regarding safety and intellectual property.

- High initial investment and ongoing maintenance costs.

- Lack of skilled AI professionals within the chemical industry.

Opportunities:

- Collaboration between AI technology providers and chemical companies for joint R&D projects.

- Expansion of generative AI applications to niche segments, such as specialty chemicals and fine chemicals.

- Integration of generative AI with other emerging technologies, such as blockchain and Internet of Things (IoT).

- Adoption of cloud-based AI platforms for easier access and scalability.

- Strategic partnerships with academic institutions to foster research and talent development.

Challenges:

- Ethical considerations surrounding AI decision-making and bias.

- Intellectual property protection and ownership concerns.

- Regulatory compliance and data privacy requirements.

- Bridging the skills gap through AI education and training programs.

- Addressing the skepticism and resistance to AI adoption within the chemical industry.

Market Segmentation

By Technology

- Machine Learning

- Reinforcement Learning

- Deep Learning

- Molecular Docking

- Quantum Computing

By Application

- Discovery of New Materials

- Production Optimization

- Pricing Optimization

- Load Forecasting of Raw Materials

- Product Portfolio Optimization

- Feedstock Optimization

- Process Management & Control

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Country Wise Revenue Share (%) – 2023

Country Revenue Share (%) The United States 35 China 25 Germany 10 Japan 05 Others 25 Recent Developments

2021

- Google AI releases DeepMind’s Chemformer: DeepMind’s Chemformer is a generative AI model that can be used to design new molecules with specific properties.

- IBM Watson Health launches Chemical Discovery Platform: IBM Watson Health launches a chemical discovery platform that uses generative AI to identify new drug candidates.

- Merck KGaA partners with Google AI: Merck KGaA partners with Google AI to develop new generative AI-powered drug discovery tools.

2022

- Ansys launches ChemSAGE: Ansys launches ChemSAGE, a generative AI platform that can be used to design new materials with specific properties.

- Dassault Systèmes launches BIOVIA Discovery Studio Cheminformatics: Dassault Systèmes launches BIOVIA Discovery Studio Cheminformatics, a generative AI platform that can be used to design new drugs.

- Microsoft launches Azure for Drug Discovery: Microsoft launches Azure for Drug Discovery, a cloud-based platform that offers generative AI tools for drug discovery.

2023

- Google AI releases ChemRL: ChemRL is a generative AI model that can be used to design new molecules with specific properties using reinforcement learning.

- IBM Watson Health launches Chemical Discovery Accelerator: IBM Watson Health launches a chemical discovery accelerator that uses generative AI to identify new drug candidates.

- Merck KGaA partners with OpenAI: Merck KGaA partners with OpenAI to develop new generative AI-powered drug discovery tools.

FAQs

1. What are the key benefits of using generative AI in the chemical industry?

- Generative AI can help to accelerate the discovery of new chemicals with specific properties.

- It can also help to reduce the cost of drug discovery.

- Generative AI can also help to improve the sustainability of chemical production.

2. What are the challenges of using generative AI in the chemical industry?

- The cost of generative AI solutions can be high.

- There is a lack of skilled manpower in the field of generative AI.

- There is also a lack of awareness about the benefits of generative AI in the chemical industry.

3. What are the future trends in generative AI in the chemical market?

- Increased adoption of generative AI in drug discovery.

- Development of new generative AI algorithms.

- Increased focus on sustainability.

- Expansion into new markets.

-

Table Of Content

Research Insights & Deliverables

Development and Future Forecast

Development and Future Forecast Competitive benchmarking

Competitive benchmarking Company Revenue Statistics

Company Revenue Statistics Rising Regional Opportunities

Rising Regional Opportunities Technology Trends and Dynamics

Technology Trends and Dynamics Technology Assessment

Technology Assessment

-

Inquiry Before Buying

Research Insights & Deliverables

Development and Future Forecast

Development and Future Forecast Competitive benchmarking

Competitive benchmarking Company Revenue Statistics

Company Revenue Statistics Rising Regional Opportunities

Rising Regional Opportunities Technology Trends and Dynamics

Technology Trends and Dynamics Technology Assessment

Technology Assessment

-

Request Sample

Research Insights & Deliverables

Development and Future Forecast

Development and Future Forecast Competitive benchmarking

Competitive benchmarking Company Revenue Statistics

Company Revenue Statistics Rising Regional Opportunities

Rising Regional Opportunities Technology Trends and Dynamics

Technology Trends and Dynamics Technology Assessment

Technology Assessment