-

Report ID 138085 -

Published Date June 2023 -

Delivery Format PDF/PPT/Word -

Editor's Rating

-

Report Details

Market Size

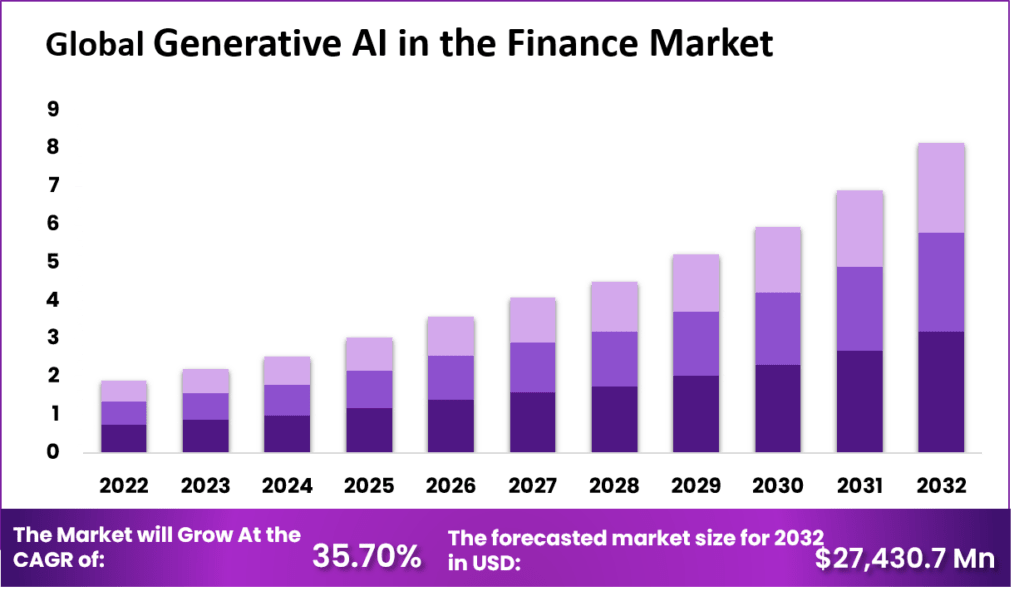

Generative AI is a type of artificial intelligence that can create new data and insights from existing data. This technology is being increasingly used in the financial services industry to improve a variety of processes, including fraud detection, risk assessment, investment prediction, and customer service.

Note – The number might vary in the actual reportKey Takeaways

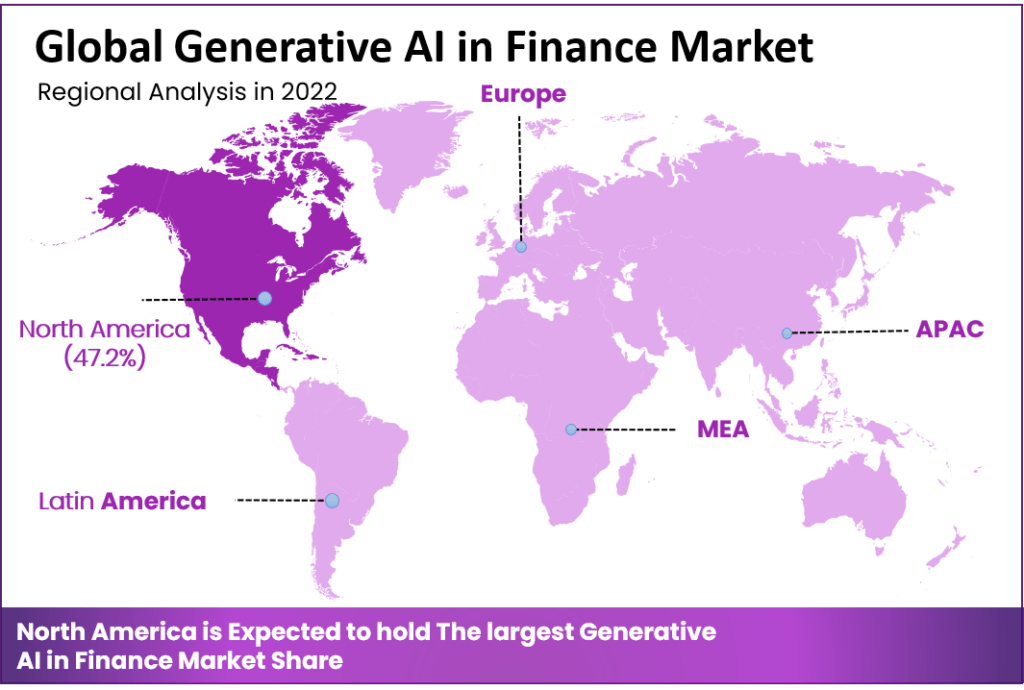

Note – The number might vary in the actual reportKey Takeaways- The largest market for generative AI in finance is North America, followed by Europe and Asia Pacific.

- The fastest-growing market for generative AI in finance is Asia Pacific, due to the increasing adoption of digital technologies in the region.

- The most important factors driving the growth of generative AI in finance market are the increasing demand for accurate and efficient financial services, the growing availability of data, and the advancements in machine learning algorithms.

Market Demand and Trend

The demand for generative AI in finance is being driven by a number of factors, including:

- The increasing complexity of the financial markets

- The need for financial institutions to provide more personalized and customized services to their customers

- The growing importance of data analytics in financial decision-making

The trend in the generative AI in finance market is towards the use of this technology for a wider range of applications, including:

- Fraud detection

- Risk assessment

- Investment prediction

- Customer service

Largest Market and Fastest Growing Market

The largest market for generative AI in finance is North America, followed by Europe and Asia Pacific. The largest market in North America is the United States, followed by Canada. The largest market in Europe is the United Kingdom, followed by Germany and France. The largest market in Asia Pacific is China, followed by Japan and India.

Technological Advancements

The technological advancements that are driving the growth of generative AI in finance market include:

- The development of new machine learning algorithms

- The development of new deep-learning techniques

- The development of new natural language processing techniques

Market Dynamics

Drivers

The major drivers of generative AI in finance market are:

- Increasing demand for accurate and efficient financial services

- Growing availability of data

- Advancements in machine learning algorithms

Restraints

The major restraints of generative AI in finance market are:

- High cost of implementation

- Lack of skilled professionals

- Regulatory challenges

Opportunities

The major opportunities of generative AI in finance market are:

- Growth of the digital economy

- Increasing adoption of AI by financial institutions

- Development of new generative AI applications

Challenges

The major challenges of generative AI in finance market are:

- Security and privacy concerns

- Lack of standards and regulations

- Ethical concerns

Target Audience to Benefit from this Report

The target audience to benefit from this report includes:

- Financial institutions

- Technology vendors

- Government agencies

- Research organizations

- Investors

Market Segmentation

Based on the Deployment Model

- Cloud Deployment

- On-Premises Deployment

- Hybrid Deployment

Based on the Application

- Risk Management

- Fraud Detection

- Investment Research

- Trading Algorithms

- Other Applications

Based on the Technology

- Deep Learning Technology

- Natural Language Processing Technology

- Computer Vision Technology

- Reinforcement Learning Technology

- Other Technologies

Key Players

- IBM Corporation

- NVIDIA Corporation

- DataRobot, Inc.

- Symphony Ayasdi

- ai

- Kavout

- AlphaSense

- Other Key Players

Recent Developments

- 2022: In 2022, there was a significant increase in the adoption of generative AI in the finance market. This was due to a number of factors, including the increasing availability of data, the development of more powerful machine learning algorithms, and the growing demand for accurate and efficient financial services.

- 2023: In 2023, the adoption of generative AI in the finance market is expected to continue to grow. This is due to the increasing number of use cases for generative AI in finance, such as fraud detection, risk assessment, investment prediction, and customer service.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

FAQs

Q1.What is generative AI?

Generative AI is a type of artificial intelligence that can create new data and insights from existing data. This can be used to improve financial decision-making, such as fraud detection, risk assessment, investment prediction, and customer service.

Q2.What are the benefits of using generative AI in finance?

There are many benefits to using generative AI in finance, including:

- Increased accuracy and efficiency: Generative AI can analyze large amounts of data to identify patterns and anomalies that humans might miss. This allows financial institutions to make better decisions and reduce risk.

- Improved customer service: Generative AI can be used to create personalized content for customers, such as financial advice or investment recommendations. This can help financial institutions to improve customer satisfaction and loyalty.

Q3. What are the challenges of using generative AI in finance?

There are a few challenges to using generative AI in finance, including:

- Data quality: The quality of the data used to train generative AI models is critical to the accuracy of the insights generated.

- Model complexity: Generative AI models can be complex and difficult to interpret. This can make it challenging to understand how the models work and to ensure that they are not biased.

Q4. How is AI used in financial markets?

AI plays a crucial role in corporate finance, specifically in enhancing loan risk prediction and assessment. Companies aiming to enhance their value can leverage AI technologies like machine learning to enhance loan underwriting processes and minimize financial risks.

Q5. What are the future trends for generative AI in finance?

The future trends for generative AI in finance include:

- Increased adoption: The adoption of generative AI in finance is expected to continue to grow in the coming years.

- New use cases: Generative AI is expected to be used for new use cases in finance, such as personalized financial planning and investment management.

- Improved accuracy and efficiency: As generative AI models become more sophisticated, they are expected to become more accurate and efficient. This will lead to further improvements in financial decision-making and customer service.

-

Table Of Content

Research Insights & Deliverables

Development and Future Forecast

Development and Future Forecast Competitive benchmarking

Competitive benchmarking Company Revenue Statistics

Company Revenue Statistics Rising Regional Opportunities

Rising Regional Opportunities Technology Trends and Dynamics

Technology Trends and Dynamics Technology Assessment

Technology Assessment

-

Inquiry Before Buying

Research Insights & Deliverables

Development and Future Forecast

Development and Future Forecast Competitive benchmarking

Competitive benchmarking Company Revenue Statistics

Company Revenue Statistics Rising Regional Opportunities

Rising Regional Opportunities Technology Trends and Dynamics

Technology Trends and Dynamics Technology Assessment

Technology Assessment

-

Request Sample

Research Insights & Deliverables

Development and Future Forecast

Development and Future Forecast Competitive benchmarking

Competitive benchmarking Company Revenue Statistics

Company Revenue Statistics Rising Regional Opportunities

Rising Regional Opportunities Technology Trends and Dynamics

Technology Trends and Dynamics Technology Assessment

Technology Assessment