-

Report ID 138039 -

Published Date June -

Delivery Format PDF/PPT/Word -

Editor's Rating

-

Report Details

Market Overview

Generative AI is a type of artificial intelligence that can create new data points from existing data. This can be used in a variety of ways in the financial services industry, such as fraud detection, risk assessment, and investment prediction.

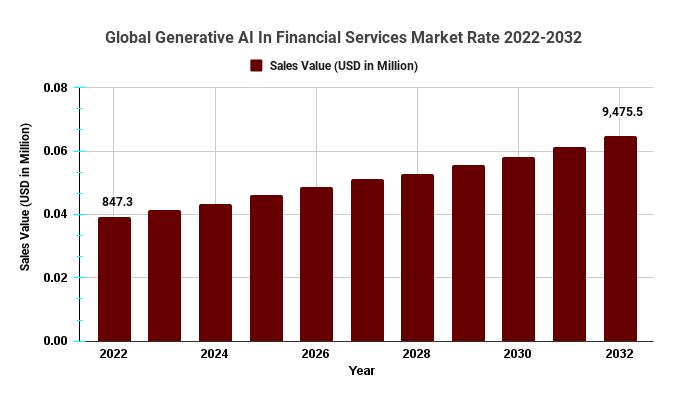

The Generative Ai In Financial Services Market recorded a valuation of USD 847.3 Mn in 2022 and is expected to reach USD 9,475.5 Mn by the end of 2032, expanding at a CAGR of 28.1% over the decade, as per the latest Tech market research report (Market.us).

Planning to lay down future strategy? Request a sample

[Please note that the figures provided are subject to change in the actual report]

Key Takeaways

- The generative AI in financial services market is a rapidly growing market with a lot of potential.

- The market is being driven by a number of factors, including the increasing demand for accurate and efficient financial services, the increased availability of data, and advancements in machine learning algorithms.

- The market is expected to continue to grow at a rapid pace in the coming years.

Market Demand

The market demand for generative AI in financial services is driven by a number of factors, including:

- The increasing demand for accurate and efficient financial services

- The increased availability of data

- Advancements in machine learning algorithms

- The growing popularity of cloud computing

Here are some of the key trends in generative AI in financial services market:

- The increasing adoption of AI by financial institutions: Financial institutions are increasingly adopting AI to improve their operations and provide better customer service. Generative AI is one of the most promising areas of AI, and it is being used by financial institutions for a variety of purposes, including fraud detection, risk management, and customer service.

- The growing demand for personalized financial services: Customers are increasingly demanding personalized financial services that are tailored to their individual needs. Generative AI can be used to create personalized financial products and services, such as investment recommendations, insurance policies, and mortgage loans.

- The need to reduce fraud and risk: Financial institutions are under pressure to reduce fraud and risk. Generative AI can be used to identify fraudulent transactions, assess risk, and prevent financial crimes.

Regional Landscape

The global generative AI in financial services market is segmented by region into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

- North America is the largest market for generative AI in financial services. This is due to the region’s large financial services industry and the high level of adoption of new technologies.

- Europe is the second largest market for generative AI in financial services. This is due to the region’s strong economic growth and the increasing demand for accurate and efficient financial services.

- Asia Pacific is the fastest-growing market for generative AI in financial services. This is due to the region’s large population, growing economy, and increasing adoption of new technologies.

Discover market potential and regional growth opportunities. Download PDF Sample Report

Technological Advancements

The rapid advancement of technology is one of the key drivers of the growth of the generative AI in financial services market. The development of new and improved machine learning algorithms is making it possible to generate more accurate and realistic data. This is leading to the development of new and innovative applications for generative AI in the financial services industry.

Market Dynamics

Drivers

The following are the drivers of generative AI in financial services market:

- Increasing demand for accurate and efficient financial services

- Increased availability of data

- Advancements in machine learning algorithms

- Growing popularity of cloud computing

Restraints

The following are the restraints of generative AI in financial services market:

- High cost of development and deployment

- Lack of skilled professionals

Opportunities

The following are the opportunities in generative AI in financial services market:

- The use of generative AI in the financial services industry can help to improve customer service, reduce fraud, and make better investment decisions.

- The market for generative AI in financial services is expected to grow at a rapid pace in the coming years.

- There is a growing demand for skilled professionals with the knowledge and experience to develop and deploy generative AI solutions.

Challenges

The following are the challenges in the generative AI in financial services market:

- The high cost of developing and deploying generative AI solutions can be a barrier to entry for some businesses.

- The lack of skilled professionals with the knowledge and experience to develop and deploy generative AI solutions can also be a barrier to entry.

- The lack of regulatory clarity around the use of generative AI in financial services can create uncertainty for businesses.

Top Leading Manufacturers

- IBM Corporation

- Intel Corporation

- Narrative Science

- Amazon Web Services, Inc.

- Microsoft

- Google LLC

- Salesforce, Inc.

- Other Key Players

(Note: The list of the key market players can be updated with the latest market scenario and trends)

Here are some recent developments in generative AI in financial services market:

- 2022: Goldman Sachs announced that it is using generative AI to create synthetic data for testing trading strategies, risk evaluation, and improving trading models.

- 2022: JPMorgan Chase invested heavily in artificial intelligence (AI) technologies in order to strengthen its risk management and fraud detection abilities.

- 2022: The European Central Bank (ECB) announced that it is working on a project to use generative AI to create synthetic data for stress testing banks.

- 2022: The Bank of England (BoE) announced that it is working on a project to use generative AI to create synthetic data for simulating the impact of different economic scenarios.

- 2023: The Financial Conduct Authority (FCA) in the UK published a report on the use of AI in financial services, which highlighted the potential benefits of generative AI in areas such as fraud detection, risk management, and customer service.

Market Segmentation

Based on Type

- Solutions

- Services

Based on Application

- Credit Scoring

- Fraud Detection

- Risk Management

- Forecasting & Reporting

- Other Applications

Based on the Deployment Mode

- Cloud

- On-premises

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Report Scope

Report Attribute Details Historical Years 2017-2022 Base Year 2022 Estimated Year 2023 Short-Term Projection Year 2028 Long-Term Projected Year 2033 Frequently Asked Questions

What is generative AI?

Generative AI is a type of artificial intelligence that can create new data points from existing data. This can be used in a variety of ways in the financial services industry, such as fraud detection, risk assessment, and investment prediction.

How is generative AI used in the financial services industry?

Generative AI can be used in a variety of ways in the financial services industry, including:

- Fraud detection: Generative AI can be used to create synthetic data that mimics real-world data. This synthetic data can then be used to train machine learning models to detect fraud.

- Risk assessment: Generative AI can be used to create synthetic data that represents different risk scenarios. This synthetic data can then be used to train machine learning models to assess risk.

- Investment prediction: Generative AI can be used to create synthetic data that represents different investment scenarios. This synthetic data can then be used to train machine learning models to predict investment returns.

What are the benefits of using generative AI in the financial services industry?

The benefits of using generative AI in the financial services industry include:

- Improved customer service: Generative AI can be used to create chatbots that can answer customer questions and provide support. This can help to improve customer satisfaction and reduce costs.

- Reduced fraud: Generative AI can be used to detect fraud more effectively. This can help to protect businesses from financial losses.

- Better investment decisions: Generative AI can be used to predict investment returns more accurately. This can help businesses to make better investment decisions and improve their financial performance.

-

Table Of Content

Research Insights & Deliverables

Development and Future Forecast

Development and Future Forecast Competitive benchmarking

Competitive benchmarking Company Revenue Statistics

Company Revenue Statistics Rising Regional Opportunities

Rising Regional Opportunities Technology Trends and Dynamics

Technology Trends and Dynamics Technology Assessment

Technology Assessment

-

Inquiry Before Buying

Research Insights & Deliverables

Development and Future Forecast

Development and Future Forecast Competitive benchmarking

Competitive benchmarking Company Revenue Statistics

Company Revenue Statistics Rising Regional Opportunities

Rising Regional Opportunities Technology Trends and Dynamics

Technology Trends and Dynamics Technology Assessment

Technology Assessment

-

Request Sample

Research Insights & Deliverables

Development and Future Forecast

Development and Future Forecast Competitive benchmarking

Competitive benchmarking Company Revenue Statistics

Company Revenue Statistics Rising Regional Opportunities

Rising Regional Opportunities Technology Trends and Dynamics

Technology Trends and Dynamics Technology Assessment

Technology Assessment