-

Report ID 137992 -

Published Date Mar 2023 -

Delivery Format PDF/PPT/Word -

Editor's Rating

-

Report Details

Latin America Factoring Services Market Overview

The Latin America factoring services market is expected to see significant growth in the coming years. The increasing adoption of factoring services by small and medium-sized enterprises (SMEs) in the region is a key factor driving this growth. Factoring allows SMEs to improve their cash flow by selling their accounts receivable at a discount to a third-party financial institution, which then assumes responsibility for collecting on those receivables.

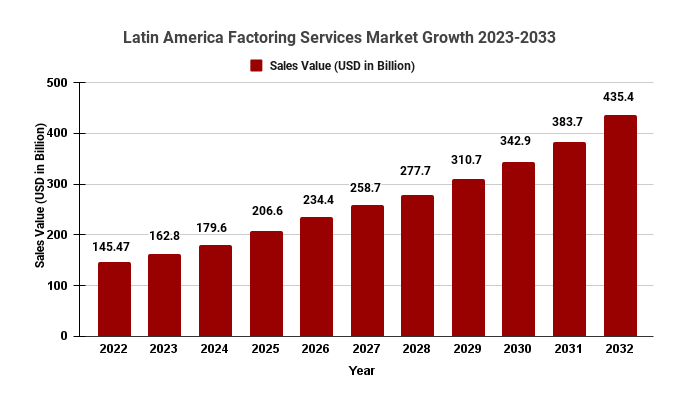

The Latin America factoring services market size was valued at USD 145.48 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 11.9% from 2023 to 2030.

Brazil is currently the largest market for factoring services in Latin America, accounting for over 50% of the total market share. However, other countries such as Mexico and Colombia are also seeing an increase in demand for these services due to government initiatives aimed at supporting SMEs and promoting entrepreneurship. Additionally, technological advancements are making it easier for companies to access factoring services online, further driving growth in the industry.

Despite these positive trends, there are also challenges facing the Latin America factoring services market. One major challenge is the lack of regulatory frameworks governing the industry in some countries. This can lead to issues with fraud and transparency that can undermine investor confidence and hinder growth. As such, regulators will need to work closely with industry stakeholders to establish clear guidelines that promote responsible lending practices while ensuring consumer protection.

To understand how our report can bring a difference to your business strategy, Ask for a brochure

Take action now and gain valuable insights into the impact of the US crisis with our comprehensive analysis report – Request a sample report

Competitive Landscape

Accion International

Barclays Plc

BNP Paribas

BTG Pactual

Deutsche Factoring Bank

FINAMCO

Hitachi Capital (UK) PLC

HSBC Group

Mizuho Financial Group

Inc.

SMB

TRADEWIND GmbHMarket Dynamics

1. Drivers

- An increasing number of SMEs in the region

- Favorable government policies and regulations

- Growing demand for working capital financing

- Increasing adoption of factoring by businesses

2. Restraints

- Lack of awareness and understanding of factoring services

- Limited availability of funding for factoring companies

- Competition from traditional banking institutions

3. Opportunities

- Expansion into new industries and markets

- Growing demand for supply chain financing

- Increasing adoption of technology and automation in the factoring industry

4. Challenges

- Limited availability of credit insurance for factoring companies

- Complex regulatory environment in some countries

- Economic instability in some countries

Latin America Factoring Services Market: Report Segmentation

- Category Outlook (Factoring Volume, USD Million)

- Domestic

- International

- Type Outlook (Factoring Volume, USD Million)

- Recourse

- Non-recourse

- Financial Institution Outlook (Factoring Volume, USD Million)

- Banks

- Non-banking Financial institutions (NBFIs)

- End-use Outlook (Factoring Volume, USD Million)

- Manufacturing

- Transport & Logistics

- Information Technology

- Healthcare

- Construction

- Others (Staffing Agencies, Advertising, Oilfield Services, and Commercial Food & Beverages, among others)

Report Scope

Report Attribute Details Forecast Years: 2023-2033 Historical Years: 2017-2022 Revenue 2023: USD 145.48 Bn Revenue 2033: USD 435.4 bn Revenue CAGR (2023 – 2033): 11.9% Fastest Growing Region United States Largest Region China Report Scope Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast 2023-2033;

Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company ProfilingRegional Coverage & Country Coverage 5 Regions & Top 22 Countries - North America – (U.S., Canada, Mexico)

- Europe – (U.K., France, Germany, Italy, Spain, Rest Of Europe)

- Asia Pacific – (China, Japan, India, South Korea, South East Asia, Rest Of Asia Pacific)

- Latin America – (Brazil, Argentina, Rest Of Latin America)

- Middle East & Africa – (GCC Countries, South Africa, Rest Of Middle East & Africa)

Short-Term Projection Year 2028 Long-Term Projected Year 2033 Frequently Asked Questions About This Report

- What is factoring?

- What is the Latin America factoring services market worth?

- Which country is the largest market for factoring services in Latin America?

- Which segment accounted for the largest Latin America factoring services market share?

- Who are the key players in Latin America factoring services market?

- What are the factors driving the Latin America factoring services market?

-

Table Of Content

Research Insights & Deliverables

Development and Future Forecast

Development and Future Forecast Competitive benchmarking

Competitive benchmarking Company Revenue Statistics

Company Revenue Statistics Rising Regional Opportunities

Rising Regional Opportunities Technology Trends and Dynamics

Technology Trends and Dynamics Technology Assessment

Technology Assessment

-

Inquiry Before Buying

Research Insights & Deliverables

Development and Future Forecast

Development and Future Forecast Competitive benchmarking

Competitive benchmarking Company Revenue Statistics

Company Revenue Statistics Rising Regional Opportunities

Rising Regional Opportunities Technology Trends and Dynamics

Technology Trends and Dynamics Technology Assessment

Technology Assessment

-

Request Sample

Research Insights & Deliverables

Development and Future Forecast

Development and Future Forecast Competitive benchmarking

Competitive benchmarking Company Revenue Statistics

Company Revenue Statistics Rising Regional Opportunities

Rising Regional Opportunities Technology Trends and Dynamics

Technology Trends and Dynamics Technology Assessment

Technology Assessment